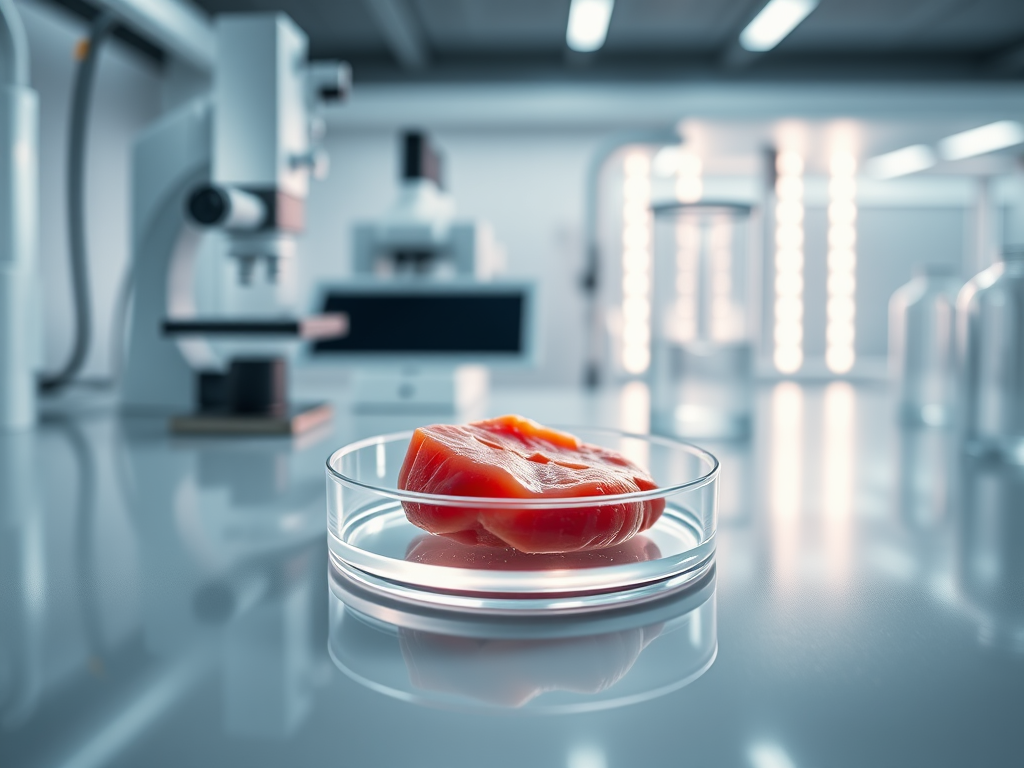

The UK’s food innovation landscape has taken a significant step forward with the Food Standards Agency’s (FSA) launch of a pioneering regulatory sandbox program designed to accelerate the approval of cell-cultivated meat products. In a move to catch up with global competitors like Singapore and Israel, the UK aims to complete safety assessments for two products within a two-year timeframe. This government-backed initiative represents a dramatic improvement over the standard process, which typically costs between £350,000 and £500,000 per product and can take more than 2.5 years to complete. The Department of Science, Innovation and Technology’s Engineering Biology Sandbox Fund has provided crucial financial support to make this ambitious timeline possible.

Breaking Down Regulatory Barriers for Food Innovation

The FSA’s regulatory sandbox represents a fundamental shift in approach to novel food approval in the UK. Traditional regulatory pathways have been notoriously slow and expensive, creating significant barriers to entry for innovative food companies. By implementing this streamlined process, the UK demonstrates its commitment to becoming a global leader in sustainable food technology while maintaining strict safety standards.

Professor Robin May, Chief Scientific Advisor at the FSA, emphasized that “Safe innovation is at the heart of this program. By prioritizing consumer safety and making sure new foods like CCPs are safe, we can support growth in innovative sectors.” This balanced approach aims to protect consumers while fostering innovation in a rapidly evolving food landscape.

The two-year timeline established for the program signals the government’s urgency in establishing the UK as a competitive market for cell-cultivated products. Running through early 2027, this initiative will help determine the future regulatory framework for all cell-cultivated foods in the UK. For companies developing these products, this represents an unprecedented opportunity to gain market access more rapidly than previously possible.

I’ve seen similar regulatory innovations happening across the food sector, including laboratory-created dairy alternatives that are reshaping our understanding of what’s possible in food production. These parallels across food tech sectors suggest a broader shift toward more agile regulatory approaches for novel foods.

Global Leaders Collaborate on UK’s Cultivated Meat Future

The FSA’s sandbox program has attracted an impressive roster of international participants, bringing together expertise from across the global cell-agriculture landscape. Eight forward-thinking companies are at the forefront, including UK-based Hoxton Farms, Roslin Technologies, and Uncommon Bio. These domestic innovators are joined by international pioneers: US-based BlueNalu, Netherlands-based Mosa Meat, France-based Gourmey and Vital Meat, and Australia-based Vow.

This international collaboration highlights the global nature of food innovation while positioning UK companies alongside world leaders in the field. Each participant brings unique expertise and technology to the table, from specialized cell lines to novel bioreactor designs. Together with academic partners and industry bodies, these companies are working to ensure that cell-cultivated products meet strict safety and quality standards.

Jim Mellon, executive chairman of Agronomics, has emphasized the importance of adequate funding for the FSA to ensure timely assessments. This acknowledgment of resource requirements demonstrates the industry’s understanding of regulatory challenges and commitment to supporting effective oversight. The program’s success depends on both private innovation and public sector capacity to evaluate these novel products efficiently.

The international dimension of this initiative mirrors broader trends I’ve observed in plant-based food markets, where global collaboration has accelerated product development and market acceptance. By bringing together diverse perspectives, the UK creates an environment where the best ideas can flourish regardless of origin.

Environmental Advantages of Cell-Cultivated Products

Cell-cultivated meat offers transformative environmental benefits compared to conventional livestock farming. Traditional meat production ranks among the largest contributors to greenhouse gas emissions globally, while also consuming vast quantities of water and land resources. By growing meat directly from cells, these innovative products can drastically reduce environmental impacts across multiple dimensions.

The UK Climate Change Committee has highlighted the need for substantial changes in food consumption patterns to meet ambitious climate goals. Cell-cultivated products align perfectly with these objectives by offering a way to enjoy meat products with a fraction of the ecological footprint. The reduced land requirements could also allow for reforestation and habitat restoration, creating additional environmental benefits beyond emissions reductions.

Lord Patrick Vallance, Science Minister, reinforced this connection between innovation and sustainability: “By supporting the safe development of cell-cultivated products, we’re giving businesses the confidence to innovate and accelerating the UK’s position as a global leader in sustainable food production.” This official endorsement underscores the strategic importance of cell-cultivated meat in achieving broader national sustainability objectives.

The environmental case becomes even more compelling when considering water resources. Traditional meat production requires thousands of liters of water per kilogram of product, while cell cultivation can dramatically reduce this requirement. This innovation joins other sustainable food developments that collectively represent a meaningful response to our planet’s most pressing environmental challenges.

Overcoming Consumer Hesitation About Lab-Grown Meat

Despite the environmental and ethical advantages, consumer acceptance remains complex for cell-cultivated meat products in the UK. Public perception spans a broad spectrum – from enthusiastic early adopters excited by innovation to skeptical consumers concerned about food safety and naturalness. This mixed reception represents one of the most significant hurdles for industry growth.

Mark Post, founder and CSO of Mosa Meat, has highlighted the crucial role of public-private partnerships in building consumer trust. These collaborations can help ensure transparency throughout the development process and communicate the rigorous safety standards applied to cell-cultivated products. Education campaigns will need to address common misconceptions while honestly acknowledging the novel nature of these foods.

Product naming and marketing will play decisive roles in consumer acceptance. Terms like “lab-grown” or “artificial” meat have proven to trigger negative responses, while phrases emphasizing cultivation or cellular agriculture tend to generate more neutral or positive reactions. Finding terminology that is both accurate and appealing represents an ongoing challenge for the industry.

Price parity with conventional meat remains another essential factor in consumer adoption. Initially, cell-cultivated products will likely command premium prices, potentially limiting their market to environmentally conscious consumers willing to pay more. However, the industry is working to reduce production costs, with the ultimate goal of making these products accessible to mainstream consumers. This evolution mirrors trends seen in other emerging food categories that started as niche offerings before achieving broader market penetration.

Innovation Frontiers: What’s Next for Cultivated Meat

The future of cell-cultivated meat hinges on technological breakthroughs in several areas. Advances in bioprocess design and cell line engineering stand as critical factors for scaling production and reducing costs. Current cultivation methods remain expensive compared to traditional livestock farming, but researchers are making steady progress in optimizing nutrient media formulations and bioreactor efficiency.

Hybrid products combining cell-cultivated components with plant-based ingredients represent a fascinating middle ground that could accelerate market adoption. These products can leverage the authentic taste and texture of cultivated animal cells while using less expensive plant proteins for bulk. This approach might offer the best of both worlds: improved sustainability and authentic meat characteristics at a more accessible price point, similar to how plant-based dessert innovations have transformed that segment.

Investment in the sector continues to grow despite economic headwinds, reflecting confidence in the long-term potential of this technology. Venture capital firms, traditional food companies, and even conventional meat producers have placed strategic bets on cultivated meat startups. This diverse funding landscape provides the financial foundation necessary for continued research and development.

As the regulatory framework evolves globally, international harmonization of standards will become increasingly important for companies operating across multiple markets. The UK’s regulatory sandbox could serve as a model for other countries seeking to balance innovation with consumer safety. By sharing data and best practices internationally, regulators can help create a more predictable environment for this emerging industry while ensuring that safety remains paramount.

Looking ahead, cell-cultivated meat may represent just the beginning of cellular agriculture’s potential. The same fundamental technologies could eventually produce novel foods impossible through traditional agriculture, opening new culinary horizons beyond simple replacements for existing products. The UK’s regulatory approach today may determine whether it leads or follows in this food revolution tomorrow.